As spring settles in and flowers begin to bloom, the rental housing industry typically transitions from the slower winter months into the busy spring leasing season. For 2025, we expect economic headwinds and changing market conditions to dampen the usually robust seasonal demand but the full impact is anyone’s guess. In this month’s update, we’ll try to answer that question as we cover highlights from the Salt Lake Board of Realtor’s 2025 Housing Forecast, discuss broader economic trends, and review recent data regarding annual rent growth.

Headlines

March Jobs Report - The U.S. labor market added 228,000 jobs in March, significantly beating expectations and up from February’s revised 117,000. Despite the strong job growth, the unemployment rate rose slightly to 4.2%. Wage growth remained steady at 0.3% for the month, while the annual rate slowed to 3.8%, the lowest since July 2024. While the report signals continued labor market strength, rising concerns over how new U.S. tariffs might spark a potential trade war and waiting to see the full effect of Federal job cuts in the data could impact future hiring.

Weekly Jobless Claims - U.S. jobless claims rose slightly to 223,000 last week, in line with expectations, amid growing uncertainty from President Trump’s tariffs. While 228,000 jobs were added in March, the unemployment rate increased to 4.2%, reflecting mixed signals in the labor market. Though layoffs remain low, hiring has slowed, and trade tensions continue to raise recession concerns. Continuing claims dropped to 1.85 million, suggesting some stability. In Utah, unemployment claims increased to 1,407, up by 156 from the previous week, hinting at early impacts of national policy on the local economy.

Consumer Price Index - U.S. inflation cooled more than expected in March, with the consumer price index (CPI) falling 0.1%, bringing the annual rate down to 2.4% from 2.8% in February. Core inflation, which excludes food and energy, rose just 0.1% on the month and dropped to 2.8% year-over-year—its lowest level since March 2021. Declines in energy prices, particularly gasoline, helped ease inflation, while food prices rose modestly. Shelter costs—a key inflation component—increased by just 0.2%.The report arrives amid uncertainty over what impact President Trump’s on again off again tariffs will have on inflation. While the White House urges the Federal Reserve to cut rates, officials remain cautious given the changing trade landscape.

Fed Meeting - The Federal Reserve kept interest rates unchanged at 4.25%–4.5%, maintaining the level set in December. Despite holding rates steady, the Fed signaled that two rate cuts are still likely later this year, depending on economic conditions. It also scaled back its quantitative tightening program by reducing the pace at which it lets Treasury bonds roll off its balance sheet. The Fed downgraded its U.S. economic growth forecast to 1.7% for the year and slightly raised its inflation outlook to 2.8%. Chair Jerome Powell cited growing uncertainty, including the potential inflationary impact of tariffs and a moderation in consumer spending, as reasons for the cautious stance.

Utah Housing Market Outlook for 2025:

Stability Amid High Prices and Slower Economic Growth

The insights in this article are drawn from the 2024 State of the Utah Housing Market report published by the Kem C. Gardner Policy Institute. The report provides a comprehensive overview of home prices, affordability trends, and market dynamics across Utah, with a particular focus on Salt Lake County. You can access the full report here.

Price Trends and Stabilization

Despite a recent cooling in housing price increases, the Utah real estate market remains one of the more expensive in the country, with affordability continuing to be a major challenge for potential homebuyers. Salt Lake County, in particular, has seen only a modest 1% rise in the median price of single-family homes, increasing from $606,000 in 2022 to $610,000 in 2024. Condominium prices have dipped slightly by 1% over the same period, from $430,000 to $425,500. This stabilization comes after a record-breaking 40% spike in housing prices from 2020 to 2022, driven by rapid demographic and economic growth.

Affordability Challenges Persist

Even as price increases stabilize, high mortgage rates continue to make homeownership out of reach for many Utahns. In the fourth quarter of 2024, the average monthly mortgage payment for a median-priced single-family home in Salt Lake County reached $4,674, assuming a 5% down payment and a mortgage rate of 6.63%. To qualify for such a mortgage, a household would need an annual income of approximately $186,960. For condominiums, the median monthly mortgage payment stands at $3,284, requiring an annual income of $131,360. These figures far exceed the county’s median household income of $101,000, limiting homeownership opportunities, particularly for first-time buyers.

As affordability tightens, buyers are shifting their focus toward more affordable housing options, such as condominiums and townhomes. In 2024, nearly one in four single-family homes sold for less than $500,000, but only 6% of single-family homes were priced below $400,000. In contrast, about 40% of condominium sales were priced below $400,000. This growing demand for lower-priced units has driven condominiums to account for nearly one-third of existing home sales in Salt Lake County, up from 17% in 2010.

Economic Factors Temper Housing Demand

The slowdown in housing sales can be attributed to a combination of high prices, elevated mortgage rates, and slower economic growth. Utah’s job growth rate, traditionally almost double the national average, has recently slowed to match the national pace. This shift has reduced net migration, a crucial driver of housing demand, from 35,000 in 2022 to just 26,000 in 2024. As employment growth is projected to remain low, net migration is also expected to decrease further, potentially softening housing demand in the coming years.

Market Adjustments and Price Stabilization

Despite affordability challenges, the Utah housing market is showing signs of stabilization as the number of active listings increases slightly, helping to alleviate some upward pressure on prices. The median number of days on the market has risen from just six days in 2021 to 30 days in 2024, closer to the long-term average of 38 days. This increase in market time reflects a balanced market, providing buyers with more choices and a slower pace of sales.

Outlook for 2025: Modest Gains and Steady Mortgage Rates

The forecast for 2025 anticipates modest increases in home sales, with condominium sales projected to rise by 8% to 4,000 units and single-family home sales to increase by 3% to 8,600 units. Home prices are also expected to experience modest gains, with the median price for single-family homes projected to rise by 2% to $620,000, while condominium prices may increase by 6% to $450,000.

Mortgage rates are expected to remain between 6% and 7% over the next 24 months, significantly higher than the historically low rates seen in 2020 and 2021. These rates will continue to shape the dynamics of the market, with affordability remaining a key concern.

Utah Real Estate Market

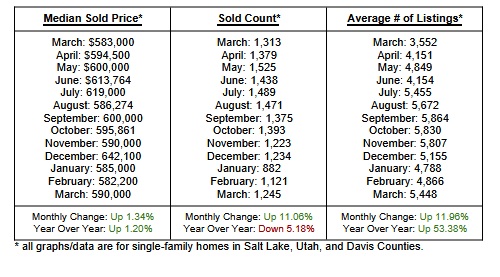

The housing market showed continued signs of momentum in March, building on February's gains. The median sold price rose to $590,000, a 1.34% increase from February’s $582,200, and up 1.20% year-over-year. This marks a return to price growth after months of fluctuation, pointing to renewed strength in property values. Sales activity also picked up, with 1,245 properties sold, an 11.06% increase from February, although still down 5.18% compared to March 2023, suggesting the market is steadily recovering but not yet at last year’s pace. The average number of active listings jumped to a 11.96% rise month-over-month, and a striking 53.38% increase year-over-year. The expanding inventory continues to provide buyers with more choices, fueling market movement but affordability issues remain.

Rent Report

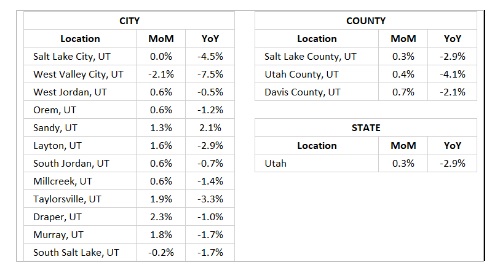

Utah’s housing market showed steady improvement in March, with most areas posting modest monthly gains despite continued annual declines. At the city level, Draper, Taylorsville, and Murray led month-over-month growth. Only West Valley City and South Salt Lake saw declines, while Salt Lake City remained flat. Year-over-year, most cities are still down, with West Valley City and Salt Lake City among the steepest drops. Sandy stood out with a 2.1% YoY increase. At the county level, all areas saw monthly gains, led by Davis County, though annual figures remain negative. Statewide, Utah rose 0.3% MoM, but is still down 2.9% YoY, signaling gradual stabilization.

Rental data provided by apartment list.

Industry Updates

FHFA Pauses Federal Landlord-Tenant Requirements - The Federal Housing Finance Agency (FHFA) has announced a three-month pause on new federal landlord-tenant requirements for multifamily properties financed through Fannie Mae and Freddie Mac. Originally set to take effect on February 28, 2025, the directive would have mandated 30-day notices for rent increases and lease expirations, and a five-day grace period for late fees. Implementation is now delayed until at least May 31, 2025. The National Apartment Association (NAA) and other industry groups opposed the directive, arguing it duplicates existing state and local regulations and creates unnecessary lease changes. The pause allows time for the Trump Administration to review whether the policy aligns with current priorities. FHFA emphasized its commitment to thoughtful policymaking and continues to gather stakeholder input

Congress Focuses on Housing Supply - On March 4, 2025, the U.S. House Housing and Insurance Subcommittee held a hearing on increasing housing supply, led by Chairman Mike Flood. The session focused on regulatory barriers, the federal role in housing, and market challenges impacting development. Three bills were introduced for future consideration, two of which are endorsed by the National Apartment Association (NAA). Chairman Flood emphasized the need to address the housing shortage to improve affordability and pledged to move supportive legislation forward. NAA continues to advocate for policies that expand supply and ease development restrictions.