In this update, we’re excited to introduce a new technology partnership, bringing all Wolfnest clients access to cutting-edge analysis tools for real estate investors. We’ll also provide key updates on the job market, highlighting slower growth and rising unemployment, along with the latest trends in inflation and insights into potential interest rate cuts. Now, let’s dive into the headlines.

Headlines

August Jobs Report - In August, the U.S. economy added 142,000 jobs, falling short of the 161,000 expected, although an improvement from July's 89,000. Despite slower job growth, the unemployment rate ticked down to 4.2%, in line with expectations. However, the "real" unemployment rate, which includes discouraged and part-time workers, rose to 7.9%, its highest since October 2021. Revisions for June and July also showed fewer jobs than initially reported. Wages rose 0.4% for the month, with an annual increase of 3.8%, both slightly higher than expected. Markets remained steady as the data fueled speculation of a potential significant interest rate cut by the Federal Reserve in its upcoming meeting.

Weekly Jobless Claims - The number of Americans filing new unemployment claims increased slightly by 2,000 to 230,000 for the week ending September 7, which aligns with economist forecasts. Despite this rise, layoffs remain low, even as the labor market shows signs of slowing down, driven by businesses reducing hiring in response to higher interest rates. Nonfarm payrolls grew less than expected in August, though the unemployment rate dropped from 4.3% to 4.2%. With inflation easing, the Federal Reserve is expected to lower interest rates by at least 25 basis points in its upcoming policy meeting. Continuing unemployment claims rose by 5,000 to 1.85 million for the week ending August 31. In Utah, the initial unemployment claims slightly decreased from the previous week, bringing the total to 1,267. This marginal change reflects a steady labor market in Utah, consistent with the national trend of slow but steady economic adjustments despite the broader labor market slowdown. Utah continues to maintain a low level of unemployment claims, indicating resilience against the backdrop of national fluctuations.

Consumer Price Index - In August, the annual inflation rate dropped to 2.5%, its lowest level since early 2021, with consumer prices rising by 0.2% for the month. Core inflation, excluding food and energy, rose by 0.3%, slightly higher than expected, keeping pressure on the Federal Reserve's monetary policy. Housing costs remained a major contributor, with the shelter index up 0.5% for the month and 5.2% year-over-year, accounting for 70% of the core inflation increase. Both July and August shared similar challenges, with housing costs being the dominant driver of inflation. Despite inflation easing, concerns about a slowing labor market have emerged as a key focus for the Fed ahead of its September meeting, with an 85% chance of a 25 basis point rate cut expected.

Fed Meeting - The upcoming Fed meeting is scheduled for September 17-18, which falls outside of this month’s publication. In the last Fed meeting, the Federal Reserve kept short-term interest rates unchanged but noted progress towards its 2% inflation target, hinting at potential future rate cuts if supported by economic data. Given the current economic landscape, it is highly likely that the Federal Reserve will opt for a modest rate cut in September to support both inflation control and labor market recovery. However, the persistent inflation in housing and mixed signals from the labor market may lead the Fed to take a cautious approach, opting for smaller adjustments while continuing to monitor the broader economic conditions closely.

A Game-Changing Tool for Real Estate Investors

We are thrilled to announce a new partnership that will bring unparalleled benefits to real estate investors looking to maximize their returns. This collaboration is designed to offer you exclusive access to advanced tools, personalized property recommendations, and expert management support to help you succeed in the ever-evolving real estate market.

What Does This Partnership Offer?

Our new partnership empowers investors with a range of benefits tailored to your real estate investment journey, from initial property search to long-term management and profitability. Here’s what you can expect:

Property Recommendations based on user specific criteria

Gain access to advanced analytics that will match you with high-potential investment properties, ensuring you focus on the best opportunities that align specifically with your goals.

Market Insights and Trends

Stay ahead of market changes with real-time data on property values, neighborhood growth, and market trends. This insight gives you the competitive edge needed to make smarter investment decisions.

Support from Wolfnest

With Wolfnest’s property management expertise, your investments are in good hands. Our team will handle everything from tenant management to maintenance, ensuring a hassle-free experience.

Streamlined Process for Investors

Our partnership simplifies every aspect of the acquisition to management process. From selecting the right property using advanced data to managing your investment efficiently, you’ll enjoy seamless, end-to-end support.

Minimizing Risk and Maximizing Returns

Our data-driven approach helps you identify investment opportunities that offer solid financials, reducing risk. Coupled with Wolfnest’s experienced property management, you’ll be positioned for long-term profitability, and can improve your ROI over time.

How to Get Started

This exclusive opportunity is available to our Wolfnest community. Click here to learn more.

Utah Real Estate Market

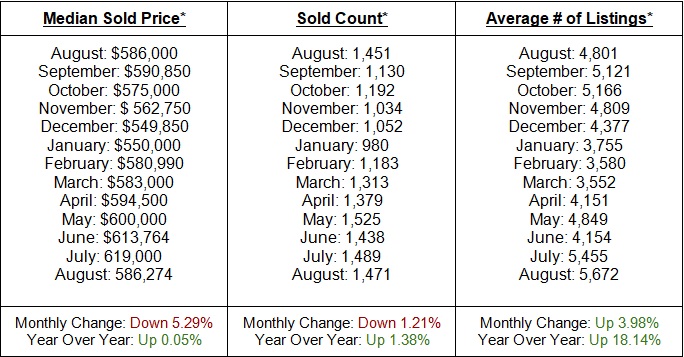

The median sold price in August fluctuated throughout the year, peaking at $619,000 in July before dropping to $586,274 in August, reflecting a 5.29% monthly decline but a 0.05% year-over-year increase. Sold counts also declined slightly showing a 1.21% monthly decrease. The average number of listings rose in August, marking a 3.98% monthly increase and an 18.14% rise year-over-year. Overall, the market showed rising listings, stable sold counts, and a slight decline in median prices

* all graphs/data are for single-family homes in Salt Lake, Utah, and Davis Counties.

Rent Report

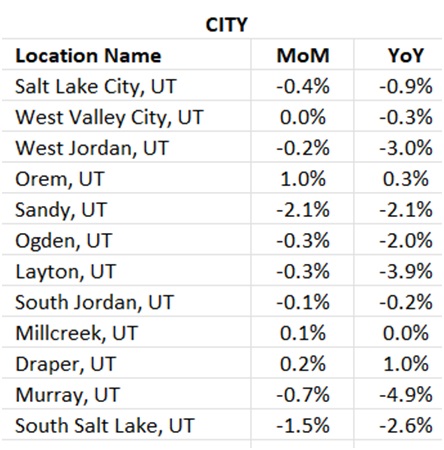

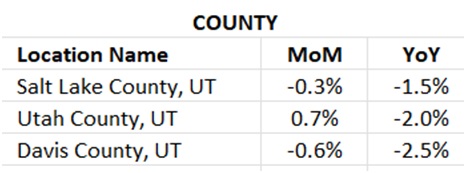

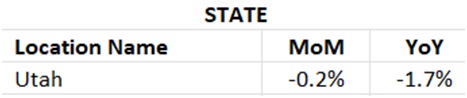

In August, the rental market in Utah displayed a mixture of upward and downward trends. Orem saw the most significant month-over-month (MoM) increase among cities, rising by 1.0%, while Draper and Millcreek also posted modest gains. Conversely, Sandy experienced the steepest MoM decline at -2.1%, followed by South Salt Lake and Murray. At the county level, Utah County showed a 0.7% MoM increase. Statewide, Utah saw a slight decline in rental rates, with a -0.2% MoM drop. The year-over-year (YoY) trend continues to show a statewide decline of -1.7%, indicating ongoing annual decreases in rental rates across the state.

|  |

|

Industry Updates

Court of Appeals Reverses NAA Eviction Moratorium Dismissal - the U.S. Court of Appeals for the Federal Circuit overturned a dismissal in the case of Darby Development Company, Inc. v. United States. The case challenges the legality of the CDC's pandemic-era eviction moratorium, arguing it constitutes a physical taking under the Fifth Amendment, which would require compensation to property owners. Initially dismissed in 2022, the Court of Appeals ruled that the housing providers' claim for compensation could proceed, likening the moratorium to a physical taking. The case will now return to a lower court for further proceedings. The National Apartment Association (NAA) and supporting organizations continue to monitor the case's progress.

White House Announces New Housing Supply Actions - On August 13, 2024, the White House announced new actions to lower housing costs and boost housing supply. Key measures include $100 million in HUD grants to remove barriers to affordable housing, increased interest rate predictability for housing finance agencies, and new guidance for residential development near transit. Additionally, there’s a push to streamline state and local permitting processes. The National Apartment Association (NAA) supports these efforts, emphasizing that increasing housing supply is the best way to make rental housing more accessible and affordable.