We continue to see surprising trends in the economy, with the job’s report exceeding expectations but inflation not completely absent. The good news is we seem to be pretty close to the “soft landing” economists were hoping for. In this month’s update, we’ll dive into these issues and touch on the ongoing legal battles around revenue management tools. But first, let’s start with the headlines.

Headlines

September Jobs Report - In September, U.S. nonfarm payrolls surged by 254,000, exceeding the 150,000 forecast and up from a revised 159,000 in August. This report stunned economists, who had anticipated a much slower pace of hiring amidst broader concerns of a cooling labor market. The unemployment rate dropped to 4.1%, signaling sustained strength in the job market. Wages also saw notable growth, with average hourly earnings rising 0.4% for the month and 4% year-over-year, both figures surpassing expectations. These numbers provide a clear indication that the labor market remains resilient, defying predictions of an economic downturn. With this robust performance, the report increases the likelihood that the U.S. economy is headed for a soft landing, reducing the likelihood of a recession. The Federal Reserve is now likely to maintain its gradual approach to interest rate cuts into November and December, with growing confidence that the economy can navigate the current challenges smoothly.

Weekly Jobless Claims - For the week ending October 5, U.S. initial jobless claims reached 258,000, an increase of 33,000 from the previous week and higher than analysts' expectations, according to the Department of Labor. The four-week moving average also rose to 231,000, up by 6,750. The seasonally adjusted insured unemployment rate remained steady at 1.2% for the week ending September 28, with the number of insured unemployed rising by 42,000 to 1,861,000. The four-week moving average for insured unemployment dropped by 1,750, settling at 1,827,500. In Utah, jobless claims increased by 231, from 1,280 to 1,511, reflecting a smaller, but notable rise compared to the national figures.

Consumer Price Index - In September 2024, the U.S. inflation rate rose to 2.4%, slightly higher than expected. Core inflation, excluding food and energy, increased 0.3% for the month, putting the annual core rate at 3.3%. Jobless claims also rose unexpectedly, reaching 258,000, the highest since August 2023, partly due to Hurricane Helene and a Boeing workers' strike. Food and shelter costs contributed significantly to inflation, while energy prices fell. The Federal Reserve is expected to continue lowering interest rates, despite rising concerns about the labor market's strength.

Fed Meeting - The Federal Reserve cut interest rates by 0.5 percentage points on September 18, 2024, the first cut since the COVID-19 pandemic, reducing the federal funds rate to a range of 4.75%-5%. This move addresses slowing inflation, and up until this past jobs report, weakening job growth. The Fed also signaled potential further cuts by the end of the year. Despite solid economic growth, concerns about the labor market, slower hiring and rising unemployment, the Fed felt compelled to make a significant cut.

Revenue Management Under Fire: New Legal Actions and Legislative Developments

Earlier this year, we covered the FBI's investigation into Cortland Management and other major players in the multifamily housing industry, suspected of engaging in rent price-fixing practices. The investigation was tied to the Department of Justice's (DOJ) criminal antitrust probe, which is scrutinizing companies like RealPage for allegedly helping landlords artificially inflate rents using their revenue management software. This system is said to allow property management companies to collude on setting maximum rent prices, leading to inflated rates that undermine fair market competition.

Fast forward a few months, and this issue has only intensified. What started as an investigation into antitrust violations has now triggered a wave of legislative action across the country, with lawmakers taking aim at the use of algorithms in determining rental prices.

Cities and States Take Action Against Revenue Management Tools

Several cities are spearheading efforts to ban or restrict the use of revenue management software. In San Jose, California, three city council members have introduced a proposal to prohibit the use of these tools for setting rents or managing occupancy levels. If passed, this ordinance will allow civil action against housing providers, with fines of up to $1,000 per violation and mandates for the return of illegal profits.

Similarly, in Philadelphia, Councilmember Nicolas O’Rourke has proposed legislation that would prevent the use of algorithm-driven revenue management systems for rental housing decision-making. His proposal would allow the city to sue housing providers, and residents could seek triple damages or $2,000 per violation. Fines could increase daily if violations continue.

These initiatives mirror the steps already taken by San Francisco, where a similar ban has been enacted. As momentum builds, more cities are following suit, signaling a nationwide trend to regulate or outright ban revenue management tools that are perceived to distort the rental market and harm tenants.

Widespread Legislative Scrutiny: States Join the Movement

Beyond individual cities, several states have also introduced bills aimed at regulating or banning the use of algorithms in rent-setting:

- New Hampshire (House Bill 1368): Targets algorithms in rental pricing, aiming to ensure transparency and prevent discrimination.

- California (AB 2230 and AB 2930): Proposes restrictions on rent-setting tools that use nonpublic data, particularly focusing on privacy concerns and the manipulation of rent prices.

- Colorado (HB 24-1057): Introduces provisions for protecting consumers from potential algorithmic discrimination in rental housing.

- Connecticut (SB 2): Aims to increase oversight on AI and algorithmic tools, including those used in rental pricing.

- New Jersey: Recently held a Housing Committee hearing focused on addressing the use of algorithms in rent setting and housing discrimination.

- New York (AB 9473): A bill aimed at regulating how algorithms influence rent prices, protecting tenant rights in the process.

- Oklahoma (HB 3453): Seeks to prohibit the use of revenue management software in rental pricing, mirroring efforts in other states.

- Rhode Island (HB 8058 & Senate companion): Aims to scrutinize and regulate the use of algorithms in setting rent prices to prevent unfair market manipulation.

While some of these bills have yet to progress through their respective state legislatures, the rising number of such proposals highlights a growing national concern over the role of algorithms in determining housing costs.

The Industry Response and Broader Impact

The National Apartment Association (NAA) continues to work with its affiliate partners to advocate against these laws. NAA argues that banning revenue management tools could worsen housing affordability and availability by limiting property owners' ability to respond to market changes efficiently.

This surge in legislative scrutiny follows the original FBI investigation into RealPage and its algorithms, which some claims allowed property management companies to collude on rent prices. The DOJ's antitrust probe, coupled with lawsuits from tenants and state attorneys general, has put the multifamily housing industry under a microscope. Time will tell where all of this lands, but as of now, we haven’t seen any action in Utah.

Utah Real Estate Market

In September, the median sold price rose to $600,000, marking a 2.34% increase from the previous month and a 1.55% year-over-year gain. The number of properties sold reached 1,375, reflecting a 6.53% monthly decline but an impressive 21.68% growth compared to the same period last year. Average listings continued to climb, showing a 3.39% monthly increase and a 14.51% rise year-over-year. Overall, the market is seeing a recovery in prices and expanding inventory.

Median Sold Price* | Sold Count* | Average # of Listings* |

September: $590,850 October: $575,000 November: $ 562,750 December: $549,850 January: $550,000 February: $580,990 March: $583,000 April: $594,500 May: $600,000 June: $613,764 July: 619,000 August: 586,274 September: 600,000 | September: 1,130 October: 1,192 November: 1,034 December: 1,052 January: 980 February: 1,183 March: 1,313 April: 1,379 May: 1,525 June: 1,438 July: 1,489 August: 1,471 September: 1,375 | September: 5,121 October: 5,166 November: 4,809 December: 4,377 January: 3,755 February: 3,580 March: 3,552 April: 4,151 May: 4,849 June: 4,154 July: 5,455 August: 5,672 September: 5,864 |

Monthly Change: Up 2.34% | Monthly Change: Down 6.53% Year Over Year: Up 21.68% | Monthly Change: Up 3.39% Year Over Year: Up 14.51% |

* all graphs/data are for single-family homes in Salt Lake, Utah, and Davis Counties.

Rent Report

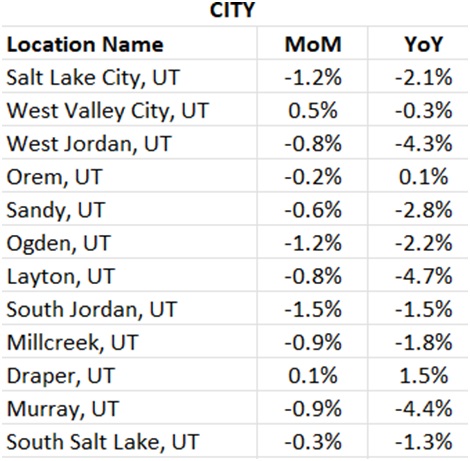

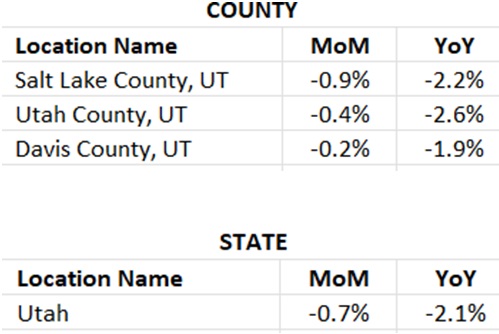

In September, the rental market in Utah continued to show mixed trends. West Valley City posted the most significant month-over-month (MoM) increase at 0.5%, with Draper also experiencing a slight rise of 0.1%. However, several cities saw declines, with South Jordan recording the steepest MoM drop at -1.5%, followed by Salt Lake City and Ogden at -1.2% each. At the county level, all regions saw declines both in MoM and YoY. The year-over-year (YoY) trend showed continued decreases, with the state experiencing a -2.1% decline, reflecting a persistent annual downtrend in rental rates.

|  |

*Rental data provided by apartment list.

Industry Updates

New Tenant Protections For Multifamily Properties - Freddie Mac and Fannie Mae, under the guidance of the Federal Housing Finance Agency (FHFA), have introduced new tenant protections for residents of multifamily properties with GSE-backed mortgages. Starting February 28, 2028, these protections will apply to properties seeking new loans and include three key standards: a 30-day notice for rent increases, a 30-day notice before lease expiration, and a 5-day grace period for late rent payments before penalties can be imposed. These measures aim to enhance transparency and communication between landlords and tenants. The new requirements will apply to all borrowers seeking GSE financing, even though many already exceed these standards.

HUD Considers Direct Rental Assistance - The U.S. Department of Housing and Urban Development (HUD) recently closed public comments on its consideration of testing a direct rental assistance model for the Section 8 Housing Choice Voucher (HCV) program, where subsidies would go directly to residents rather than housing providers. While no funding or implementation is currently planned, the National Apartment Association (NAA) supports improving the HCV program, which provides rental aid to low-income households. NAA, along with other industry groups, submitted comments advocating for a more efficient, attractive system for housing providers, suggesting an EBT-style model like SNAP and proposing incentives like waiving federal inspections for properties already approved by state or local authorities. NAA will continue to engage with HUD on future policy developments to improve the program.