In this update, we’ll highlight the latest jobs and inflation data and fill you in on the most recent Federal Reserve interest rate action. We'll also discuss a recent housing forecast for 2025, giving you a look ahead at what the coming year may bring for the housing market and outlining how the election results might impact the rental housing industry. Finally, we’re pleased to report a successful milestone in rent collection, marking our highest collection rate of the year. As always, though, we will start with the headlines.

Headlines

October Jobs Report - In October, the U.S. economy added only 12,000 jobs, a significant decline from previous months and well below expectations. However, the data doesn’t exactly tell the full story as weak job growth was impacted by hurricanes in the Southeast and a major Boeing strike, which likely reduced manufacturing employment by 44,000 jobs. Although the unemployment rate held steady at 4.1%, job creation revisions for August and September lowered the total by 112,000 jobs. Economists suggest that these disruptions may be temporary rather than signs of a declining labor market, yet concerns about the impact of high interest rates on employment persist.

Weekly Jobless Claims - U.S. weekly jobless claims rose slightly to 221,000 amid recent hurricane and strike disruptions. Continuing claims increased by 39,000 to 1.892 million, though job growth is expected to rebound in November as disruptions ease. Inflation concerns remain, with Q3 labor costs up 1.9%, while productivity grew by 2.2%. The Fed’s recent rate cut aims to manage inflation, but rising labor costs pose a challenge. In Utah, initial jobless claims also saw a slight increase, with 1,517 claims filed, up by 43 from the previous week’s 1,474. This reflects a minor uptick in unemployment claims at the state level, aligning with broader national trends in job market fluctuations.

Consumer Price Index - The upcoming Consumer Price Index (CPI) release on November 13 will fall outside this month's publication window, and we'll cover its findings in the next issue. Meanwhile, last September, U.S. inflation rose slightly above expectations, with the consumer price index (CPI) increasing 0.2% for the month, resulting in a 2.4% annual inflation rate. Jobless claims unexpectedly spiked marking a 14-month high. The rise in jobless claims suggests a softening labor market, a key concern for the Federal Reserve. With inflation slightly above the 2% target, markets expect another quarter-point rate cut at the November 6-7 meeting as the Fed aims to balance inflation control with labor market stability.

Fed Meeting - The Federal Reserve’s Federal Open Market Committee (FOMC) unanimously voted to lower the benchmark interest rate by 25 basis points, setting the new target range at 4.5%-4.75%. In its statement, the Fed acknowledged that labor market conditions have generally eased, with a slight rise in the unemployment rate, though it remains low. The Fed removed language suggesting confidence in sustainable inflation progress, now noting that inflation is making progress toward the 2% goal but remains slightly elevated. The statement maintains that risks to achieving employment and inflation objectives remain balanced.

Housing Market Predictions for 2025 vs 2024: What Buyers and Sellers Can Expect

2025 Predictions: Lower Mortgage Rates but Continued Price Pressure

Looking ahead to 2025, forecasts are slightly more optimistic regarding mortgage rates, which could see further reductions. The Federal Reserve’s recent rate cuts are expected to gradually drive down borrowing costs, making homeownership more attainable. However, this could also spur a surge in demand, potentially sustaining high home prices.

Experts predict that while home prices will continue to rise, the rate of increase should moderate. Fannie Mae projects a 3% year-over-year growth by the end of 2025, while the National Association of Realtors and the Mortgage Bankers Association suggest a range of 2.7% to 3.8%. This slower appreciation rate could offer some relief, though affordability remains a key concern for buyers.

Key Differences Between 2024 and 2025 Forecasts

Inventory Levels: In 2024, inventory rose as homeowners adapt to the current market, especially with multifamily rental units entering the scene. By 2025, this trend may solidify with increased housing starts and the so-called “silver tsunami” of baby boomers transitioning out of their homes, adding more supply to the market over time.

Affordability: Both years are projected to show slight improvements in affordability, but 2025’s anticipated drop in mortgage rates could be a game-changer. Lower rates would mean more purchasing power, which might ease the financial strain on buyers, even as home prices continue to rise gradually.

Price Stabilization: While 2024 forecasts call for marginal price declines or stability, 2025 could bring a more sustained balance, with growth rates slowing. This may create a healthier market for both buyers and sellers, reducing the extreme price spikes and volatility seen in recent years.

Long-Term Rental Market Impacts: Apartment.com’s projections suggest the rental market could cool further with increased supply. However, if homeownership barriers persist through 2025, demand for rentals may remain strong, especially in high-demand urban areas.

The “Silver Tsunami” Effect: As more baby boomers age out of the market, there could be a gradual increase in available homes, particularly in the single-family category. This trend may help ease inventory pressures, providing more options for first-time buyers in particular. However, experts believe it could take several years to see its full impact.

What to Expect in 2025 and Beyond

While 2024’s market might offer a glimpse of stability, 2025 holds the promise of more favorable conditions for both buyers and sellers. Lower mortgage rates could make homeownership more attainable, potentially sparking increased sales activity. Buyers may see more inventory options and stable price growth, while sellers could benefit from steady demand.

However, the recent presidential election adds a layer of unpredictability to the housing market’s future. The incoming administration, led by President-elect Trump, seems unlikely to prioritize the blueprint for a Renters’ Bill of Rights, which had focused on measures to enhance renter protections and boost housing affordability. This blueprint proposed federal support for rent controls, eviction protections, and other renter-focused policies that aimed to address ongoing housing affordability challenges. For renters, the change in direction may mean that relief from escalating rent costs could take longer than anticipated, with future policies likely leaning more toward a market-driven approach.

Despite these shifts, the market’s underlying fundamentals—such as decreasing mortgage rates, gradual inventory gains, and demographic changes—should continue to shape opportunities for homebuyers and sellers. Clarity on how the new administration will approach housing policy will likely develop in the coming months, helping to shape the 2025 landscape further.

As these changes unfold, staying informed and financially prepared will be essential for both prospective buyers and sellers, who may need to navigate shifting policies and market conditions in the evolving real estate landscape.

Utah Real Estate Market

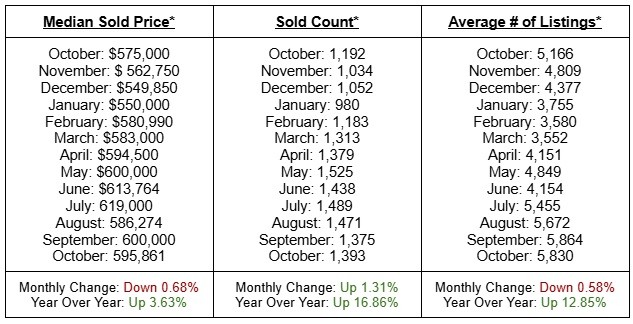

In October, the median sold price slightly decreased, reflecting a 0.68% drop from the previous month but still showing a 3.63% increase year-over-year. The number of properties sold rose to 1,393, marking a monthly and yearly increase. The average number of listings slightly decreased too but still showed an increase year-over-year. Overall, the market continues to show resilience, with stable prices, increased sales activity, and a growing inventory base that supports ongoing demand.

* all graphs/data are for single-family homes in Salt Lake, Utah, and Davis Counties.

Rent Report

In October, the rental market in Utah showed a general decline in both month-over-month (MoM) and year-over-year (YoY) metrics across various cities, counties, and the state of Utah as a whole. Most cities and counties reflect similar downward trends, with notable decreases in areas like Layton (-2.9% MoM, -5.8% YoY) and Davis County (-1.9% MoM, -3.5% YoY). Some cities, such as West Valley City and Draper, saw slight increases on a yearly basis, indicating mixed performance across the state.

*Rental data provided by apartment list.

Industry Updates

DOJ Sues Landlords Over Banning Tenants with Felonies - The U.S. Department of Justice has filed a lawsuit against the owners and managers of Suburban Heights Apartments near St. Louis, alleging racial discrimination against Black tenants through a blanket ban on applicants with felony convictions and certain criminal histories. The lawsuit claims this policy, enforced from at least November 2015 to January 2024, violated the Fair Housing Act by disproportionately affecting Black individuals and denying them housing opportunities. The policy did not consider the age or nature of the felony, which the DOJ argues is neither an accurate predictor of future behavior nor justified. Evidence was gathered via the DOJ’s Fair Housing Testing Program. The lawsuit seeks monetary damages, a civil penalty, and a court order to prevent future discrimination.

New Federal Rule to Replace Lead Service Lines - the Biden Administration updated its Lead Pipe and Paint Action Plan, aiming to replace all lead pipes in the U.S. within 10 years. The EPA’s new Lead and Copper Rule Improvements (LCRI) requires public water systems and governmental entities to identify and replace lead service lines, including those in rental properties, within this timeframe. The rule lowers the lead action level from 15 μg/L to 10 μg/L, requiring more systems to address lead contamination. The EPA emphasizes public education to inform renters and housing providers about replacement efforts. HUD has committed over $420 million in grants to support lead hazard removal, with additional federal funding available. The National Apartment Association (NAA) continues to advocate for a balanced approach, addressing the financial impact of regulatory changes on housing providers.