March marks a pivotal time for rental housing professionals, ushering in the early days of the busy leasing season. However, economic uncertainty and shifting market dynamics are making this year less predictable. While we expect the increase in seasonal demand to boost occupancy as usual, rental softness across most Utah submarkets combined with broader economic headwinds could shape a different outcome. As such, we have been prioritizing renewals earlier in the year to hedge against this possibility. In this month’s update, we’ll analyze how these trends might impact housing providers, recap key takeaways from the recently completed 2025 Utah Legislative Session, and update you on recent changes to both our yard care policy during vacancy and our general policies and procedures. But first, let’s dive into this month’s headlines.

Headlines

February Jobs Report - The U.S. added 151,000 jobs in February, below expectations but better than January’s revised 125,000. The unemployment rate rose slightly to 4.1%. Wages grew 0.3% for the month, with annual wage growth at 4%, slightly below forecasts. Despite ongoing job growth, signs of weakness emerged: labor force participation dropped to 62.4%, and broader unemployment rose to 8%. The number of part-time workers seeking full-time jobs also increased sharply. Markets reacted cautiously, as political uncertainty and workforce cuts raise concerns about future economic stability.

Weekly Jobless Claims - U.S. weekly jobless claims fell to 220,000, reflecting ongoing labor market stability, but risks remain due to government spending cuts and trade tensions. Federal layoffs and rising and broader unemployment point to possible trouble ahead. In Utah, new jobless claims increased slightly to 1,557 from 1,542 the previous week — a modest rise of 15 claims, suggesting that while the state's job market remains relatively stable. However, Utah is not immune and could also start to feel the impact of broader national trends. The Federal Reserve is expected to hold interest rates steady for now but may cut rates by June if economic pressures grow.

Consumer Price Index - U.S. inflation eased to 2.8% in February, lower than expected, with core inflation at 3.1%. Both headline and core prices rose just 0.2% for the month, offering some relief amid tariff concerns. Shelter costs, a major driver, rose 0.3%. The report suggests inflation is moderating, increasing chances the Federal Reserve may cut rates later this year, though rates are expected to remain steady at the next meeting.

Fed Meeting - The Federal Open Market Committee (FOMC) will meet next on March 19, with markets widely expecting interest rate cuts later in 2025. In its January meeting, the Federal Reserve kept interest rates unchanged at 4.25%-4.5%, pausing after three cuts since September 2024. While acknowledging that the labor market remains strong, the Fed noted that inflation is still above the 2% target, leading to a more cautious outlook on future rate cuts.

2025 Final Legislative Session

The 2025 Utah Legislative Session has concluded. Out of the many housing-related bills considered during Utah's 2025 Legislative Session, five major bills passed, focusing on property management licensing, landlord-tenant reforms, squatter prevention, affordable housing, and real estate regulation updates. Meanwhile, several high-profile bills related to HOA governance, rental protections, and zoning enforcement failed to advance. These pieces of legislation impact homeowners, renters, landlords, property managers, HOAs, and real estate professionals. Below is a summary of key bills and their final outcomes:

Bills That Passed

HB 337 – Property Manager Revision (Rep. Teuscher)

Creates a separate licensing process and regulations specifically for property managers to ensure higher professional standards in property management.HB 480 – Landlord Communication Amendments (Rep. Shallenberger)

Streamlines landlord-tenant communications, allowing security deposits to be returned electronically, and limits judicial discretion regarding restitution orders in eviction cases.SB 55 – Unauthorized Use of Residential Property Amendments (Sen. Balderee)

Targets squatting issues, making it easier for property owners to remove unauthorized occupants and clarifying legal processes.SB 181 – Affordable Housing Amendments (Sen. Fillmore)

Introduces new affordable housing measures to promote access to housing across Utah.SB 201 – Real Estate Amendments (Sen. Harper)

Implements general updates and reforms in real estate regulations to improve industry practices.

Bills That Did Not Pass

HB 86 – Homeowners Association Requirements (Rep. Brooks)

Sought to impose penalties on HOAs that fail to provide required documents to homeowners.HB 119 – Solar Panel Restrictions in HOAs Amendments (Rep. Owens)

Would have allowed HOAs to impose restrictions on solar panel installations.HB 262 – HOA Board Education Amendments (Rep. Acton)

Proposed mandatory education requirements for HOA board members.HB 149 – Single Family Homes Ownership Amendments (Rep. Clancy)

Proposed restrictions on single-family home ownership to address housing availability.HB 151 – Home Sales Amendments (Rep. Bennion)

Would have required homeowners to offer their homes to current renters before selling and limited rental conversions.HB 182 – Rental Amendments (Rep. Bennion)

Aimed to establish a 60-day notice period for rent increases and lease terminations.HB 261 – Towing Amendments (Rep. Maloy)

Proposed reforms to towing practices, including allowing car owners to reclaim personal property from towed vehicles.HB 419 – Real Estate Revisions (Rep. Walter)

Would have required the Division of Real Estate to prioritize certain complaints.HB 126 – Unauthorized Use or Residential Real Property Modifications (Rep. Lisonbee)

Targeted squatters and unauthorized property use but failed to move forward.HB 256 – Municipal Zoning Amendments (Rep. Walter)

Proposed to overturn the Knotwell Rule to allow stricter city enforcement of zoning.SB 125 – Eviction Amendments (Sen. Blouin)

Sought to eliminate treble damages in unlawful detainer (eviction) cases.

Please note that while the legislative session has concluded, the Governor has 20 days from the session's end to sign or veto bills. Therefore, some bills that have passed the Legislature may still be awaiting the Governor's signature to become law.

For a comprehensive view of all bills considered during the session, you can refer to the official Utah Legislature website.

Utah Real Estate Market

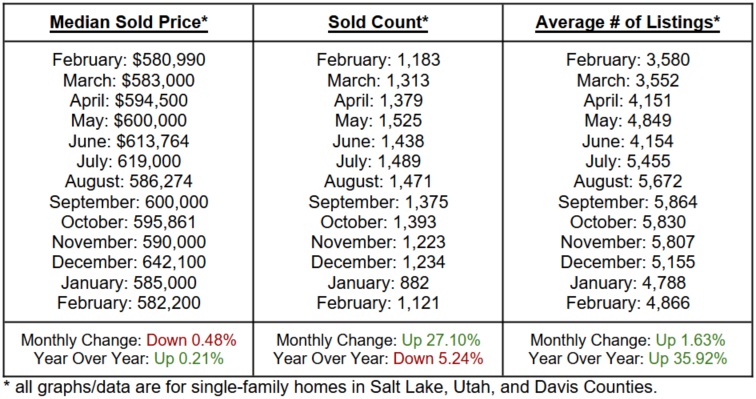

The housing market showed subtle shifts in February. The median sold price edged down 4.79% from January to $582,200, though it remains relatively stable compared to the past year. Sold count rose 27.10% month-over-month, reaching 1,121, yet reflects a 5.24% decline year-over-year, signaling lingering market adjustments. Meanwhile, the average number of listings saw a modest 1.63% increase from January, totaling 4,866 active listings, and marks a 35.92% jump compared to February last year, highlighting a significantly expanded inventory. While prices have slightly softened, the steady growth in listings and improved sales activity suggest that buyer interest is returning alongside increased options in the market.

Rent Report

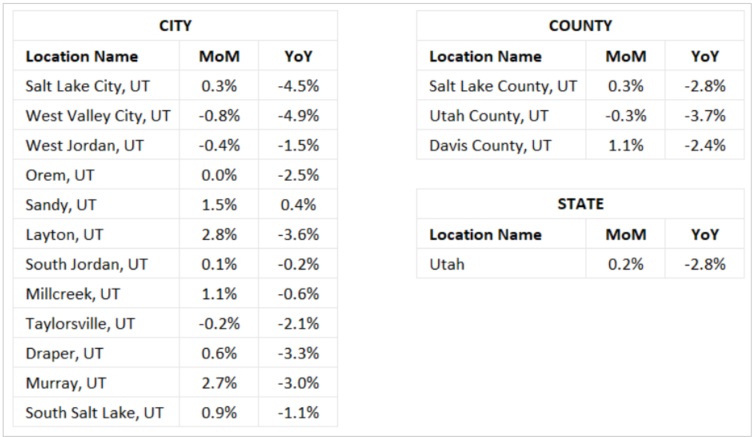

Utah’s market showed a mix of modest gains and continued declines in February. At the city level, several areas posted positive month-over-month (MoM) growth, with Layton (2.8%) and Murray (2.7%) leading the way. Meanwhile, West Valley City (-0.8%), West Jordan (-0.4%), and Taylorsville (-0.2%) experienced slight declines. On a year-over-year (YoY) basis, most cities remained in negative territory, with West Valley City, Salt Lake City, and Layton reflecting some of the steeper annual drops. At the county level, Davis County posted the strongest MoM growth, while Utah County recorded a -0.3% dip. Statewide, Utah saw a slight 0.2% MoM increase, though it continues to trend -2.8% YoY, signaling that while there are signs of stabilization in some areas, broader market recovery remains gradual.

*Rental data provided by apartment list.

Industry Updates

Trump Orders Regulatory Freeze, Halting New Federal Rules Impacting Housing - On Inauguration Day, President Trump issued a regulatory freeze on all federal agencies' rulemaking activities pending review by his appointees, halting or delaying pending and soon-to-be-effective regulations. This move may relieve housing providers from implementing Biden-era rules scheduled for 2025. The directive covers not only formal rulemaking but also broader agency policies and interpretations, potentially rolling back burdensome regulations. Impacted actions may include landlord-tenant requirements from the Federal Housing Finance Agency, HUD's 30-day notice rule, and other rules from the Department of Energy and OSHA. The National Apartment Association (NAA) supports this action and is engaging with regulators to ensure housing industry interests are represented.

New Bill Seeks to End Outdated CARES Act Eviction Notice Requirement - On February 6, 2025, lawmakers reintroduced the Respect State Housing Laws Act (S. 470/H.R. 1078) to eliminate the lingering CARES Act notice to vacate requirement, which was intended to be temporary but remains in effect due to a drafting error. Sponsored by Reps. Barry Loudermilk and Vicente Gonzalez and Sens. Bill Hagerty and Cindy Hyde-Smith, the bill aims to restore state and local control over eviction notice periods. The National Apartment Association (NAA) and National Multifamily Housing Council (NMHC) strongly support the measure, arguing that the outdated federal requirement creates confusion, operational challenges, and harms housing affordability. NAA has made passing this bill a top priority for the 119th Congress.