This month we are excited to announce that we have two new features rolling out before the end of June (and have two major announcements coming in next month's update so stay tuned!). In addition, we will discuss the highest rent collection rate of the year, new legislation addressing affordable housing, current inflation trends, and the key takeaways from the latest Federal Reserve meeting. Let's dive into the headlines.

Headlines

May Jobs Report - In May, the U.S. economy added 272,000 nonfarm payroll jobs, significantly exceeding the expected 190,000 and up from April's 165,000. Despite this growth, the unemployment rate rose to 4%, the highest since January 2022, with a drop in labor force participation to 62.5%. The strong job report contradicts concerns of economic slowdown, making a near-term Federal Reserve rate cut less likely. Following the report, market reactions included a decline in stock futures and a rise in Treasury yields. The Fed will have its hands full digesting this report as well as Wednesday’s CPI as they decide what to do with interest rates during this week's meeting.

Weekly Jobless Claims - The number of Americans filing new claims for unemployment benefits rose to a 10-month high last week, indicating a softening labor market. For the week ending June 8, initial claims for state unemployment benefits increased by 13,000 to a seasonally adjusted 242,000, the highest since last August. This surpasses economists' forecast of 225,000 claims. In Utah, the number of advance claims for unemployment benefits was 1,481 for the week, an increase of 375 from the prior week's 1,106. The climbing jobless claims and the robust jobs report present a puzzling labor market picture. Rising unemployment claims suggest a weakening job market, but strong job additions and wage growth indicate economic resilience, reflecting sector-specific dynamics where some industries shed jobs while others grow.

Consumer Price Index - In May, the Consumer Price Index (CPI) showed no increase month-over-month but rose 3.3% year-over-year, slightly below expectations. Core CPI, excluding food and energy, increased 0.2% monthly and 3.4% annually, also below forecasts. Stock market futures rose, and Treasury yields fell in response.The report influenced expectations for Federal Reserve actions, increasing the likelihood of a rate cut in September. However, Fed officials stress the need for sustained positive inflation data before easing policy. The Fed is expected to update its economic projections, considering the latest CPI figures, but continues to focus more on the personal consumption expenditures price index.

Fed Meeting - The Federal Reserve maintained its benchmark lending rate for the seventh consecutive time, signaling fewer rate cuts this year than previously anticipated. Only one rate cut is expected in 2024, down from the three forecasted in March, due to ongoing inflation concerns. Fed Chair Jerome Powell noted that the May CPI report showed better-than-expected inflation data, but emphasized the need for further slowing before reducing rates. Borrowing costs for loans and mortgages will remain high. Interest rates have been at a 23-year high since March 2022's rate hikes. The May CPI showed annual inflation at 3.3%, indicating some progress toward the 2% target. Powell expressed optimism about the strong labor market, noting it hasn't overheated, reducing inflationary pressure. Market expectations for a potential rate cut in September have increased, but the Fed will remain data-dependent, assessing trends over several months before making further decisions.

The Federal Yes In My Backyard Act Passes Key House Committee

The House Financial Services Committee unanimously passed the Yes In My Backyard (YIMBY) Act, H.R. 3507, with a 48-0 vote on May 16. Sponsored by Congressman Mike Flood (R-NE) and Derek Kilmer (D-WA), the Act mandates that recipients of Community Development Block Grants (CDBG) periodically report on their progress in removing discriminatory land use policies and implementing policies that support affordable housing. This requirement is intended to bring greater transparency and accountability to the community development process.

The National Apartment Association (NAA) led a diverse coalition to support the legislation, overcoming initial hurdles. The committee's debate was positive, with only one amendment proposed, which failed. With committee approval, attention now turns to the full House of Representatives and the companion Senate bill (S. 1688) sponsored by Senators Todd Young (R-IN) and Brian Schatz (D-HI).

The U.S. faces a significant housing shortfall, needing to build 4.3 million new apartment homes by 2035 to meet rental housing demand and address affordability issues, including an existing deficit of 600,000 apartments due to underbuilding following the 2008 financial crisis. The rental housing industry confronts numerous challenges, such as rising costs and regulatory burdens at all government levels, which hinder new construction, development, and renovation. The YIMBY Act seeks to address these issues by promoting regulatory reforms and reducing state and local barriers to apartment development.

Next Steps for the Federal YIMBY Act: The House Financial Services Committee has passed the YIMBY Act, and it now awaits consideration by the Full House of Representatives. For the bill to become law, it must be passed in identical form by both the House and Senate and then be signed by the president. This legislation could significantly impact the housing market by addressing critical regulatory and policy barriers, fostering more affordable and inclusive housing nationwide.

Utah Real Estate Market

In May, Utah's real estate market showed robust growth. The median sold price rose to $600,000, up 0.93% from April and 2.56% year-over-year, indicating ongoing property value appreciation. Sold transactions surged to 1,525, a 10.59% increase from April, reflecting strong buyer demand. Active listings climbed to 4,849, up 16.82% from April, showcasing a healthy inventory growth. Despite fluctuating interest rates, the market remains resilient, with rising property values and increased sales activity, indicating sustained buyer interest.

Median Sold Price* | Sold Count* | Average # of Listings* |

May: $585,000 June: $590,000 July: $590,000 August: $586,000 September: $590,850 October: $575,000 November: $ 562,750 December: $549,850 January: $550,000 February: $580,990 March: $583,000 April: $594,500 May: $600,000 | May: 1,518 July: 1,372 August: 1,451 September: 1,130 October: 1,192 November: 1,034 December: 1,052 January: 980 February: 1,183 March: 1,313 April: 1,379 May: 1,525 | May: 3,480 July: 5,522 August: 4,801 September: 5,121 October: 5,166 November: 4,809 December: 4,377 January: 3,755 February: 3,580 March: 3,552 April: 4,151 May: 4,849 |

Monthly Change: Up 0.93% | Monthly Change: Up 10.59% Year Over Year: Up 0.46% | Monthly Change:Up 16.82% Year Over Year: Up 39.34% |

* all graphs/data are for single-family homes in Salt Lake, Utah, and Davis Counties.

Rent Report

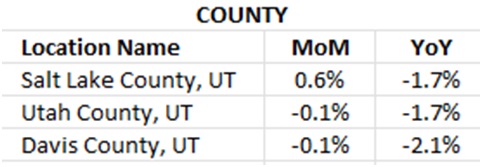

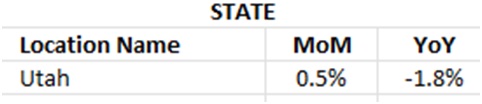

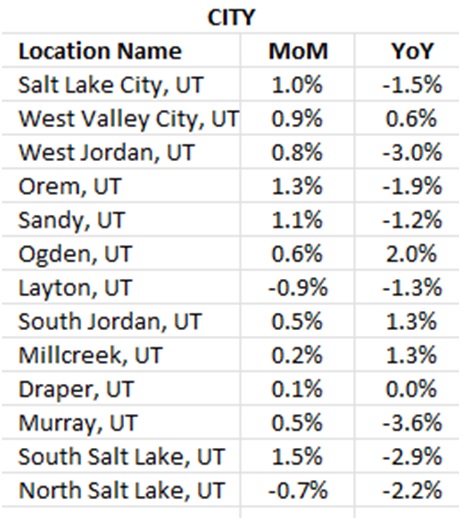

In May, rental rates across Utah showed varied trends. Most of the cities experienced month-over-month increases except for Layton and North Salt Lake which reported declines in rental rates for the same period. Statewide, Utah saw a 0.5% month-over-month increase in rental rates, though rates were down 1.8% compared to the previous year.

|

|

*Rental data provided by apartment list.

Industry Updates

HUD Releases Fair Housing Guidance for Resident Screening, Online Ads - On May 2, 2024, HUD issued guidance on using artificial intelligence in resident screening and online targeted advertisements. The National Apartment Association (NAA) expects increased federal regulatory activity before the next Congressional Review Act (CRA) deadline. HUD's guidance, aligning with the Biden Administration’s interpretation of renters' protections, emphasizes housing providers' responsibility to ensure compliance with the Fair Housing Act, even when outsourcing screening. It also warns against fair housing violations in AI-targeted ads based on protected characteristics. NAA will help members understand new compliance responsibilities and continues to advocate for resident screening as a vital risk mitigation tool.

Mortgage rates move up after weeks of dips - After a period of decline, the 30-year fixed-rate mortgage average increased to 7.03% this week, up from 6.94% last week, according to Freddie Mac's PMMS. Similarly, the 15-year FRM rose to 6.36% from 6.24% the previous week. Economic factors, including inflation concerns and Treasury auction demand, influenced the rise in mortgage rates, with experts suggesting that markets are adjusting interest rate cut expectations. While the timing and extent of rate cuts remain uncertain, slowing inflation and economic growth may lead to a decrease in mortgage rates to around 6.5% by the end of 2024. The housing market's trajectory for the year depends on mortgage rate movements, with existing homeowners holding off on selling and increasing listing activities potentially improving affordability for buyers.