This month’s update has something for everyone. We have positive national economic data regarding employment and inflation, improving local rental and real estate market statistics, and a good old fashioned price fixing scandal in the property management industry. Additionally, we’ll provide a sample of our new leasing update reports and tease two exciting new service enhancements that will be launching over the next two months. Let's jump right in!

Headlines

June Jobs Report - In June, the U.S. economy added 206,000 nonfarm payroll jobs, surpassing the expected 200,000 but below the revised May figure of 218,000. The unemployment rate rose to 4.1%, the highest since October 2021, with labor force participation increasing slightly to 62.6%.Despite long-standing forecasts of a more pronounced downturn, the U.S. labor market has remained resilient, with job prospects staying strong even as employers moderate their hiring efforts. The latest report indicates that conditions are gradually tightening which is exactly what the Fed is hoping to see. Market reactions included a slight rise in stock futures and negative Treasury yields, with increasing bets on a Federal Reserve rate cut in September.

Weekly Jobless Claims - The number of Americans filing new applications for unemployment benefits dropped by 17,000 to 222,000 for the week ending July 6, surpassing expectations of 236,000. This decrease marks the lowest level since late May. Despite the noise in the data, signs indicate the labor market is cooling due to significant interest rate hikes by the Federal Reserve in 2022 and 2023. In Utah, jobless claims also showed improvement. Advance claims fell to 1,297 from the prior week's 1,550, marking a decrease of 253 claims. This indicates a positive trend in the state's labor market, aligning with the overall national improvement.

Consumer Price Index - In June, US consumer prices fell by 0.1%, marking the first monthly decline since May 2020. This brought the annual inflation rate down to 3% from 3.3% in May, the slowest pace since June 2023. Excluding food and energy, the core CPI also rose by just 0.1%, its slowest pace since August 2021, bringing the annual core inflation rate to 3.3% from 3.4%. The better-than-expected report has raised hopes for a Federal Reserve rate cut as early as September, potentially followed by another in December. Interest rates have been at a 23-year high due to the Fed's inflation-fighting measures.

Fed Meeting - The upcoming Federal Reserve policy meeting is on July 30-31, 2024, and the consensus expectation is that they will hold rates steady. However, the recent June CPI report, showing a 0.1% decline in consumer prices, increases the probability of implementing rate cuts as early as their September meeting. The cooling inflation provides the Fed with more flexibility to ease monetary policy and support continued economic growth. While the Fed aims to balance employment and price stability, the decision will heavily depend on upcoming economic data and the ongoing risks associated with high-interest rates. At the last meeting, the Federal Reserve held rates steady at 5.25-5.50%, pausing its rate-hiking campaign that began in March 2022. The Fed plans to keep rates unchanged until inflation nears the 2% target, despite recent moderation.

FBI Searches Property Management Company in Rent Price-Fixing Investigation

Disclaimer: RealPage owns Propertyware, which is our management software, but we do not use the multifamily pricing algorithms that are the subject of this suit.

The FBI conducted an unannounced search of Cortland Management's headquarters in Atlanta on May 22 as part of an investigation into alleged rent price-fixing in the multifamily housing industry. The search was connected to a Department of Justice (DOJ) investigation into potential antitrust violations. Cortland, a major national apartment developer, confirmed the search and stated that they are fully cooperating, though neither the company nor its employees are currently considered targets of the investigation.

This action is part of a broader DOJ criminal antitrust probe into claims that Cortland and other property management companies conspired to artificially inflate apartment rents. The investigation is linked to RealPage, a software company accused of helping landlords set maximum rent prices in a coordinated manner, which Arizona Attorney General Kris Mayes described as monopolistic and harmful to Arizona's housing market. The alleged conspiracy has led to multiple lawsuits from tenants across the country, which have been consolidated in federal court in Nashville.

A ProPublica investigation previously reported that RealPage's rent-setting algorithms might violate antitrust laws by enabling landlords to maximize profits unfairly. RealPage has denied these allegations, while the DOJ noted that algorithms represent a significant new challenge for antitrust enforcement, potentially posing greater competitive threats than traditional methods of collusion.

Lawsuit against RealPage

Arizona Attorney General Kris Mayes has sued RealPage for allegedly creating a "rental monopoly" by helping landlords inflate rents in Arizona's largest cities. The lawsuit claims RealPage's pricing algorithm allows landlords to suppress competition, leading to rent increases of 30% to 76% over six years. Similar lawsuits have been filed in Seattle, Boston, and New York.

RealPage's software, which influences pricing for 4.5 million housing units nationwide, is accused of directing landlords on rent prices, undermining fair market practices. Despite RealPage's denial of enforced pricing, a ProPublica investigation found landlords adopted up to 90% of its recommendations. These lawsuits, including others consolidated in federal court in Nashville, could set precedents for software use in rental pricing and address anticompetitive practices in the industry.

Utah Real Estate Market

In June, the median sold price for homes in Utah rose to $613,764 in June, up 2.30% from May and 4.03% year over year, indicating rising property values. The number of homes sold month over month decreased the same as the year over year data, reflecting a slight market cooling.

The average number of listings was down 14.33% from May but up 3.28% year over year, showing fluctuating inventory but an overall increase. Despite monthly declines in sales and listings, the market shows stable and growing property values year over year.

Median Sold Price* | Sold Count* | Average # of Listings* |

June: $590,000 July: $590,000 August: $586,000 September: $590,850 October: $575,000 November: $ 562,750 December: $549,850 January: $550,000 February: $580,990 March: $583,000 April: $594,500 May: $600,000 June: $613,764 | June: 1,522 July: 1,372 August: 1,451 September: 1,130 October: 1,192 November: 1,034 December: 1,052 January: 980 February: 1,183 March: 1,313 April: 1,379 May: 1,525 June: 1,438 | June: 4,022 July: 5,522 August: 4,801 September: 5,121 October: 5,166 November: 4,809 December: 4,377 January: 3,755 February: 3,580 March: 3,552 April: 4,151 May: 4,849 June: 4,154 |

Monthly Change: Up 2.30% | Monthly Change: Down 5.70% Year Over Year: Down 5.52% | Monthly Change: Down 14.33% Year Over Year: Up 3.28% |

* all graphs/data are for single-family homes in Salt Lake, Utah, and Davis Counties.

Rent Report

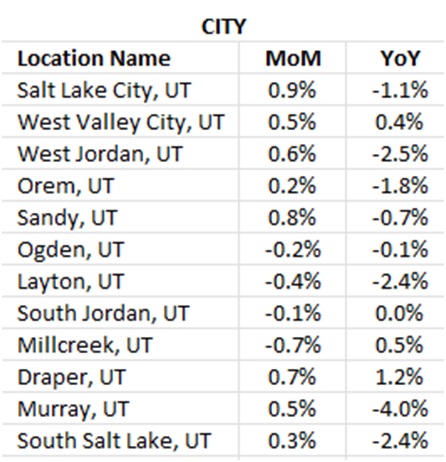

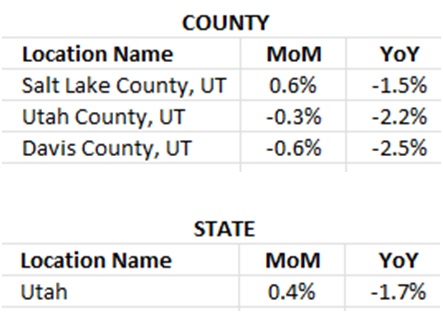

In June, the rental market across Utah exhibited a mix of upward and downward trends. Among cities, Salt Lake saw month-over-month increases in rental rates reporting a notable 0.9% rise. However, several cities, including Layton, experienced declines, with a rate decreasing by 0.4% from the previous month. Overall, Utah experienced a statewide month-over-month increase of 0.4% in rental rates. Despite this growth, statewide rental rates remained 1.7% lower compared to the previous year, indicating a continuing trend of year-over-year declines across the state.

|  |

*Rental data provided by apartment list

Industry Updates

HUD’s Criminal Screening Proposal - On June 10, 2024, the public comment period for HUD's proposed rule on criminal screening, aimed at reducing barriers to HUD-assisted housing, closed. This rule would change how housing providers conduct criminal screenings, imposing a three-year lookback period, strict guidelines on convictions, and new pre-admission denial notices. The National Apartment Association (NAA) fears these changes might eventually apply to all housing providers. NAA, with other housing organizations, submitted feedback and over 2,000 members participated in NAA's call to action. HUD acknowledged NAA's concerns, particularly by excluding certain programs to encourage participation. NAA continues to advocate as the rule moves forward.

U.S. Sees Surge in Single Family Built-For-Rent Construction - Construction of single-family built-for-rent homes in the U.S. is on the rise, with about 18,000 homes started in the first quarter of 2024, a 20% increase from the same period in 2023, according to the National Association of Home Builders (NAHB). This growth is partly due to the housing affordability crisis, which makes renting a more attractive option when buying a home is out of reach. Experts note that as mortgage rates remain high, more potential buyers are turning to rental properties. The trend reflects a broader move towards built-for-rent properties, which doubled their share of all housing starts from 5% in 2021 to 10% in 2023. With the typical asking rent for a single-family home rising to $2,262 in May 2024, compared to $1,896 for multifamily units, and median mortgage payments also increasing, renting offers an alternative to those unable to afford home purchases.