Happy New Year! As we step into 2025, we are focused on what lies ahead. Overall, the U.S. economy ended 2024 on a strong footing, marked by robust job growth, easing inflation trends overall, and strategic adjustments by the Federal Reserve to sustain economic stability. As we move forward, key data on employment, inflation, and monetary policy will continue to provide valuable insights into the evolving economic environment. However, this month's update will put a special focus on the presidential transition from Biden to Trump and how these administrations differ on housing policy. Together, we hope to paint a comprehensive picture of the economic landscape and outline what we can expect in 2025.

Headlines

December Jobs Report - The U.S. economy ended 2024 on a high note, adding 256,000 jobs in December and lowering the unemployment rate to 4.1%, marking 48 straight months of job growth. For the year, the economy added 2.2 million jobs (averaging 186,000 per month) with wage growth of 3.9% annually, and outpaced inflation for 19 consecutive months. While the labor market remains strong, seasonal hiring, hurricane recovery, and slowing job growth suggest some challenges ahead. The Federal Reserve, focusing on inflation and labor market stability, is unlikely to cut rates in January, with future rate decisions expected to hinge on continued economic progress into 2025.

Weekly Jobless Claims - The number of Americans filing new unemployment claims unexpectedly fell by 10,000 to 201,000 for the week ending January 4, signaling a stable labor market despite challenges for some laid-off workers finding jobs. This drop is below the forecasted 218,000 claims. The labor market stability is supported by a rise in job openings, with 1.13 vacancies per unemployed person in November. In Utah, unemployment claims increased by 79 from the prior week, reaching 1,573, compared to 1,494 the previous week. The Federal Reserve, after reducing rates slightly in December, is expected to keep rates steady amid uncertainties over the incoming administration's policies.

Consumer Price Index - Last November, the annual inflation rate rose slightly to 2.7%, with a 0.3% monthly increase in the Consumer Price Index (CPI), while core inflation held steady at 3.3% annually and 0.3% monthly. These figures aligned with expectations, bolstering confidence in the Federal Reserve’s recent decision to cut interest rates by 25 basis points, as outlined in its latest policy update. Inflation remains above the Fed’s 2% target, prompting cautious deliberation on the pace of future rate adjustments. Looking ahead, the next CPI report is scheduled for release on January 15, 2025 and will be watched closely by the markets since inflation has remained stubbornly persistent.

Fed Meeting - Last December 18, The Federal Reserve cut its benchmark interest rate by 25 basis points to 4.25%-4.5%, marking the third consecutive reduction. Chair Jerome Powell called the decision a "closer call" but emphasized the Fed's shift to a less restrictive policy. Future cuts are expected to be limited, with projections of only two reductions in 2025. Despite strong economic growth forecasts (2.5% for 2024) and stable unemployment (4.2%), markets reacted negatively, with the Dow dropping over 1,100 points and Treasury yields rising as investors would prefer to see multiple rate cuts in the new year. The Fed, however, aims to balance inflation control with steady economic conditions while adopting a cautious approach to further rate adjustments.

Key Trends for the Rental Housing Industry in 2025: A Shift in Policy Agendas

As we step into 2025, the rental housing industry is poised for transformative changes driven by a shift in political leadership and evolving economic priorities. The transition from the Biden administration to the Trump administration marks a pivotal moment, introducing contrasting approaches to housing policy. Here are the key differences in their agendas, the potential implications for stakeholders, and what lies ahead in addressing housing affordability and supply challenges.

Housing Affordability in Focus

The Biden administration prioritized expanding affordable housing through government-backed programs and subsidies. These efforts aimed to address a national housing shortage, skyrocketing costs, and rent-to-income ratios that strained household budgets. In contrast, President-elect Trump’s agenda signals a departure from direct federal intervention, favoring market-driven solutions to increase housing supply and affordability.

Election Impacts on Housing Policy

The 2024 election results signaled a shift in federal housing priorities. President-elect Donald Trump emphasized deregulation, market-driven solutions, and homeownership promotion as cornerstones of his housing policy agenda. Key proposals include:

Reducing Mortgage Rates: Trump proposed lowering mortgage rates by combating inflation and opening select federal lands for new home construction, aiming to increase housing supply and make homeownership more accessible.

Cutting Regulations: He emphasized the need to eliminate unnecessary regulations that contribute to high housing costs, suggesting that deregulation could reduce construction expenses and stimulate development.

Promoting Homeownership: The agenda includes tax incentives to support first-time homebuyers, intending to make purchasing homes more attainable for new entrants into the housing market.

Addressing Immigration's Impact: Trump proposed measures to ban mortgages for undocumented immigrants, asserting that such steps would mitigate increases in housing costs attributed to illegal immigration.

With Republican control of Congress, these initiatives are likely to gain legislative traction, paving the way for significant policy shifts.

Comparing Biden vs. Trump Housing Agendas

The transition from Biden to Trump represents a stark divergence in housing policy philosophy. Below is a side-by-side comparison of their key priorities:

Policy Area | Biden Administration | Trump Administration (Incoming) |

GSE Role & Reform | Expanded the role of Fannie Mae and Freddie Mac in affordable housing, reversing efforts to privatize. | Likely to reinstate efforts to privatize GSEs, reduce government intervention, and prioritize financial stability. |

Affordable Housing Focus | Increased subsidies and GSE-backed programs for affordable housing, prioritizing accessibility. | Likely to scale back GSE involvement in subsidized housing and focus on market-driven solutions for housing supply. |

Regulatory Approach | Loosened enterprise capital requirements for GSEs, allowing for riskier loans to support housing goals. | Expected to reintroduce stricter capital requirements to ensure GSEs' financial soundness and reduce systemic risks. |

Multifamily Housing | Expanded GSE involvement in multifamily markets to boost housing inventory. | Likely to limit GSE participation in multifamily markets to mitigate financial risks. |

Qualified Mortgage Rules | Extended the Qualified Mortgage Patch, enabling higher debt-to-income loans for borrowers. | Expected to end the QM Patch, prioritizing risk reduction over expanded credit access for higher-risk borrowers. |

Pandemic Response Legacy | Focused on direct federal aid (e.g., ARP) to support renters and housing programs, leading to inflationary effects. | Likely to avoid large-scale direct aid, focusing instead on deregulatory measures to stimulate market activity. |

Market Risk Management | Prioritized affordability, even at the expense of increased exposure to high-risk loans and market instability. | Expected to emphasize financial stability, reducing government-backed exposure to high-risk loans. |

Likely Industry Impacts in 2025

Moving forward, the rental housing sector could experience reduced federal intervention and a stronger emphasis on private market solutions. While deregulation may lower costs for developers, scaling back affordable housing programs could strain low-income renters. Meanwhile, homeownership incentives may shift demand, potentially easing rental market pressures but challenging landlords to adapt to evolving tenant preferences.

Utah Real Estate Market

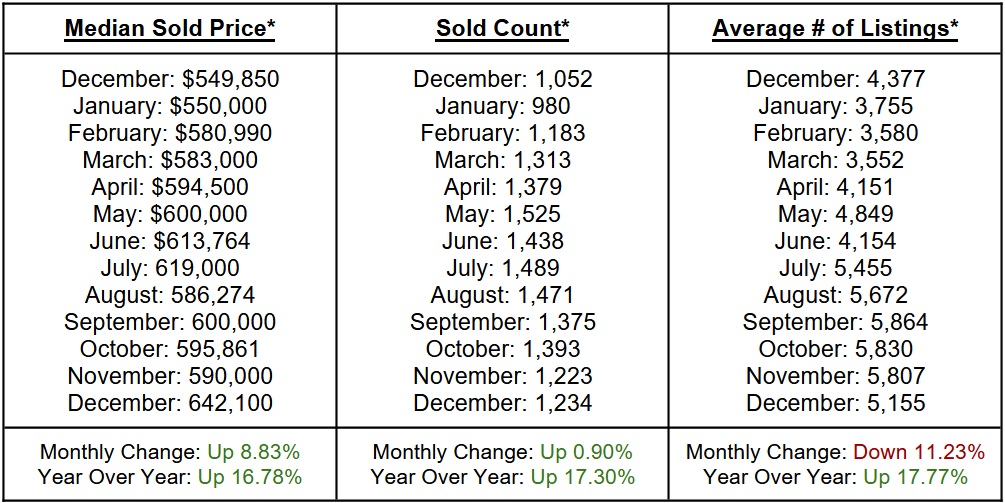

The housing market experienced notable growth throughout the year, with the median sold price increasing steadily, reflecting an 8.83% monthly rise and a 16.78% year-over-year increase. The sold count also showed positive trends, with December recording 1,234 transactions. Average listings, while fluctuating, ended at 5,155 in December, marking a slight decline of 11.23% from the previous month but a strong 17.77% year-over-year increase. Overall, the data highlights a robust and growing real estate market.

* all graphs/data are for single-family homes in Salt Lake, Utah, and Davis Counties.

Rent Report

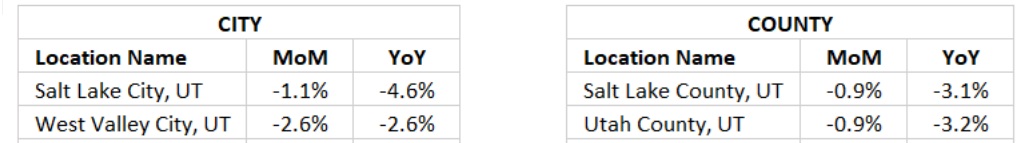

Most cities in Utah experienced month-over-month (MoM) declines in performance in December, ranging from -0.1% in West Jordan to -2.9% in Murray. However, South Jordan showed a slight positive growth of 0.7%, and Millcreek remained stable with no change. Year-over-year (YoY) performance also reflected declines across all cities. At the county level, Salt Lake County, Utah County, and Davis County all recorded MoM declines and the YoY changes were similarly negative, with Utah County experiencing the largest annual decrease of -3.2%. Statewide, Utah saw a MoM decline of -0.9% and a YoY decline of -3.1%. These figures indicate consistent trends of slight decreases across cities, counties, and the state as a whole, with only a few exceptions showing stability or minor growth.

*Rental data provided by apartment list.

Industry Updates

DOJ widens case against landlords - The Justice Department and Attorneys General from 10 states have sued RealPage and six major landlords, including Greystar, LivCor, and Camden, for using algorithmic pricing and sharing sensitive rental data to inflate rents across 1.3 million units nationwide. The landlords allegedly colluded through RealPage software, direct communications, and group discussions to coordinate rental pricing, harming millions of renters. A consent decree with Cortland requires them to stop using competitor data and pricing algorithms and cooperate with the investigation. The expanded lawsuit aims to end these practices and promote housing affordability but it’s anyone’s guess how this will be prioritized within the incoming administration.

2025 Apartment Housing Outlook - The 2025 Apartment Housing Outlook reveals steady apartment demand, improved occupancy, and rent stabilization despite oversupply in some markets like Austin and Phoenix. Job and wage growth supported renter confidence, while inflation eased and remained under 3%. Multifamily housing starts declined due to financing challenges, with fewer completions expected in 2025 and 2026, potentially leading to rental shortages and higher rents. Effective rent growth is forecasted to normalize in 2025 (2.6%-4.8%) and 2026 (3.0%-4.0%). High interest rates and immigration policies may impact the market, but improving transaction volumes and a favorable federal policy environment suggest a positive outlook overall.