As we approach the end of the year, December offers a perfect time to reflect on the challenges of 2024 and look forward to what 2025 might bring. In this month’s update, we’ll explore the recent Jobs Report and Consumer Price Index Report, both of which set the stage for the Federal Reserve’s upcoming policy decisions. We’ll discover how inflation and labor market dynamics are influencing rate cuts and broader economic strategies that affect Utah landlords. Finally, we’ll dive into a declining rental market and outline actionable strategies for navigating its challenges as well as share insights to help you succeed in this shifting landscape. We also want to take this opportunity to thank you for your business and to send our best wishes to you and your family for a wonderful holiday season.

Headlines

November Jobs Report - In November, U.S. nonfarm payrolls surged by 227,000, surpassing expectations of 214,000 and rebounding from a revised 36,000 in October, which was impacted by a labor strike and Hurricane Milton. The unemployment rate rose slightly to 4.2%, with the labor force participation rate dropping to 62.5%. Wages increased by 0.4% month-over-month and 4% year-over-year, exceeding expectations. This data supports predictions of a Federal Reserve interest rate cut in December. The mixed labor market signals come amid broader economic resilience but continued inflationary pressures, setting the stage for potential policy adjustments by the Fed.

Weekly Jobless Claims - New U.S. jobless claims rose unexpectedly to 242,000 for the week ending December 7, surpassing forecasts of 220,000. Continuing claims increased to 1.88 million, signaling longer unemployment durations for some workers. While the labor market shows signs of cooling, with unemployment rising to 4.2%, November job growth remained strong after October disruptions. The Federal Reserve is likely to cut interest rates next week to support the economy despite slow inflation progress. In Utah, initial unemployment claims saw a significant increase, rising by 656 from the prior week's 1,792 to 2,448. This jump aligns with the broader trend of labor market cooling, as reflected in rising claims nationwide. The increase in specific states like Utah further underscores the regional impacts of the slowing labor market.

Consumer Price Index - In November, the annual inflation rate accelerated to 2.7%, up slightly from October, driven by a 0.3% monthly increase in the Consumer Price Index (CPI), while core inflation remained steady at 3.3% annually and 0.3% monthly. These figures met expectations, reinforcing market confidence in a Federal Reserve interest rate cut at next week's policy meeting, with traders assigning a 99% probability to a quarter-point reduction. Although inflation has moderated from its 2022 peak, it remains above the Federal Reserve's 2% target. Policymakers are likely to assess the pace of further rate cuts as inflation shows resilience. If a cut occurs, it will mark a total reduction of one percentage point in the federal funds rate since September.

Fed Meeting - The Federal Open Market Committee (FOMC) previously reduced the benchmark interest rate by 25 basis points, setting it at 4.5%-4.75%, citing a slightly eased but still robust labor market. As the December 18-19 meeting approaches, policymakers are expected to weigh another rate cut with cautious forward guidance. The focus will likely remain on balancing inflation control and economic growth, while signaling a data-driven approach into 2025. Persistent inflation concerns and the resilience of the labor market will be central themes, with a potential pause in further cuts early next year if progress on inflation slows.

Navigating a Shifting Rental Market: Insights, Challenges, and Strategies for Success

The rental market in late 2024 is navigating uncharted waters, marked by historically high market times, declining tenant demand, and increased competition among landlords. After years of rapid rent growth and strong market performance, both the national and local rental markets are experiencing a significant correction, driven by economic pressures, increased housing supply, and evolving tenant preferences. This comprehensive overview of current market trends highlights the underlying causes of these challenges, and offers actionable strategies to help owners with a winter season vacancy navigate this new reality.

Market Trends Overview:

Historically High Market Times:

August 2024 was the worst August for market times since 2017.

Market times were 10% longer than August 2023 and 29% longer than August 2022.

This extends a trend of increased market times that began in June 2023.

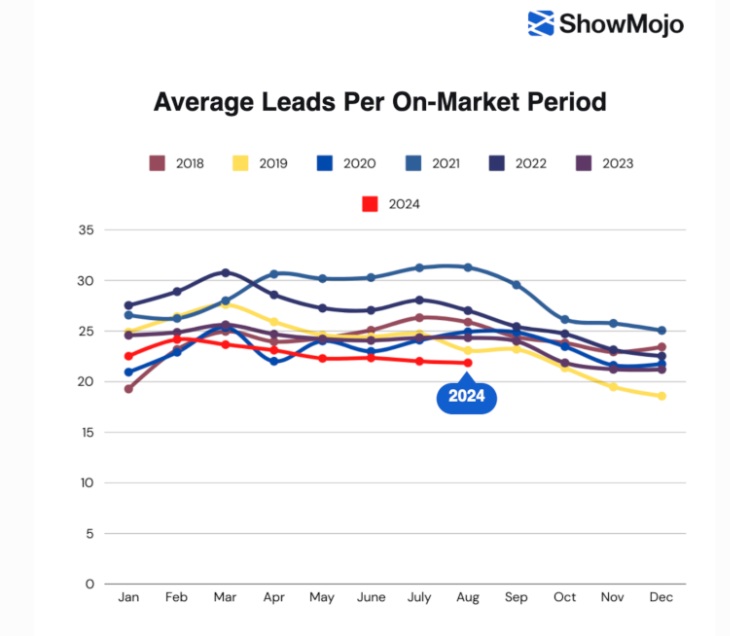

Decline in Leads Per On-Market Period:

Average leads per on-market period reached the lowest levels recorded since 2017.

Leads of August 2024 were 11% lower than August 2023 and 24% lower than August 2022.

The graph below shows a consistent seasonal pattern where renter activity peaks from March to June and declines steadily from July through December each year. August consistently marks the start of the lowest levels of leads, reflecting late-summer slowdowns. However, 2024 stands out with significantly lower average leads compared to prior years, particularly in late summer,

highlighting weaker market demand.

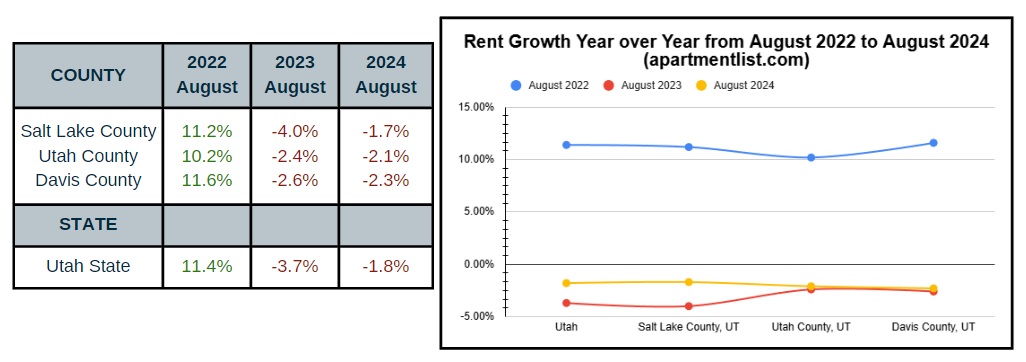

- Historic Rent Reductions:

Rent reductions in August 2024 increased by 9% compared to August 2023 and 37% compared to August 2022.

August 2024 rent growth remains negative across Utah and its counties, demonstrating the impact of diminished market demand during the late summer season. The upcoming seasonal decline in demand, combined with sustained negative rent growth in 2023 and 2024, highlights the increased pressure facing landlords

Rent Growth Year over Year from August 2022 to August 2024 (apartment list)

Pet-Friendly Listings on the Rise:

Listings allowing dogs increased by 8% and cat-friendly listings by 7% from 2023 to 2024. This reflects a growing trend of property managers adjusting policies to meet tenant demand for pet-friendly housing.

Causes of Current Market Challenges

Economic Pressures:

High interest rates are increasing housing costs.

The resumption of student loan repayments reduces renters’ disposable income.

Rising household debt limits tenant budgets.

Market Overcorrection:

After years of rapid rent growth, the market is normalizing.

Rental rates are declining, especially for certain property types like condos and townhomes.

Increased Supply:

New rental units are entering the market.

Conversion of short-term rentals and second homes into long-term rentals adds competition.

Seasonal Trends:

The rental market naturally slows during the winter months (November to January), as fewer people move during holidays and colder months.

Misplaced Optimism Among Owners:

Many owners are pricing properties based on personal financial needs rather than adjusting to declining market demand.

What to Expect Operating in This Reality

Longer Vacancies:

Days on the market are significantly higher, with properties taking 26-40% longer to lease compared to previous years.

Fewer Leads:

Tenant inquiries are down by 10-22% compared to past years.

Reduced tenant demand makes it harder to secure leases quickly.

Higher Rent Reductions:

Record levels of rent reductions, up by 45-88% compared to recent years.

Incentives like free rent or discounts are now necessary to remain competitive.

Increased Competition:

More rental properties are vying for a shrinking tenant pool, forcing landlords to differentiate their offerings.

Seasonal Slump:

Expect continued slow leasing activity through the winter months, with a gradual recovery in spring/summer unlikely to reach previous peaks.

Actionable Steps to Mitigate Rental Market Challenges

1. Understand the Market

Analyze Local Trends: Use tools and reports to evaluate market data, including rental rates, demand, and tenant preferences.

Focus: Track metrics like market times, leads per on-market period, and rent reductions to gauge competitiveness.

Monitor Tenant Preferences: Adapt to growing trends, such as the demand for pet-friendly properties and flexibility in leasing terms.

Stay Informed: Regularly review market updates to identify opportunities and potential risks.

2. Ensure the Property Shows Well

Property Maintenance:

Keep properties clean, updated, and move-in ready.

Address any maintenance issues before listing the property.

Aesthetic Upgrades:

Invest in minor improvements like fresh paint, modern fixtures, and clean landscaping.

Highlight Key Features:

Emphasize pet-friendly amenities or unique property features to attract targeted tenants.

3. Have a Comprehensive Marketing Strategy

Leverage Professional Content:

Use high-quality photos, video tours, and 3D walkthroughs to showcase the property.

Expand Advertising Channels:

List properties on popular rental platforms, social media, and local community boards.

Use targeted ads to reach prospective tenants effectively.

Streamline the Process:

Simplify application processes and reduce unnecessary pre-showing screening questions to encourage more inquiries.

Engage Online:

Promote properties with engaging descriptions that highlight lifestyle benefits (e.g., nearby parks for pet owners).

4. Offer Move-In Incentives

Attractive Perks:

Provide offers like reduced deposits, a month of free rent, or gift cards to stand out in a crowded market.

Flexible Lease Terms:

Offer shorter lease durations to attract renters looking for flexibility, aligning end dates with peak rental seasons.

Referral Programs:

Incentivize current tenants to refer new renters by offering rewards for successful leads.

5. Price Aggressively

Set Competitive Rates:

Use real-time market data to price rentals at or slightly below similar properties to attract more tenants.

Adjust Quickly:

Respond to market conditions by lowering rent or offering discounts when leads are low or market times are increasing.

Avoid Overpricing:

Focus on aligning rental prices with tenant budgets, even if it means not covering all operational costs initially.

Utah Real Estate Market

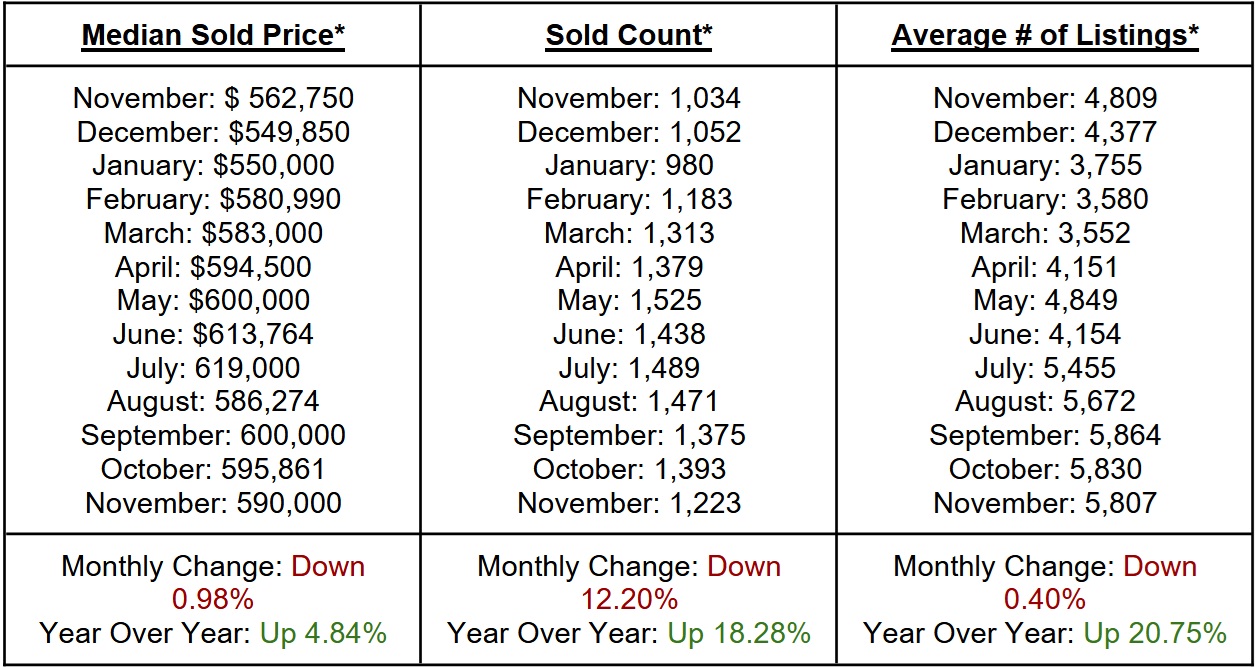

In November, the median sold price experienced a modest decline of 0.98% compared to the previous month but maintained a strong year-over-year growth of 4.84%. The number of properties sold reached 1,223, representing a monthly decrease of 12.20%. While the average number of listings saw a slight monthly dip, it remained higher than the same period last year. Overall, the market continues to demonstrate resilience, with stable pricing trends, increased sales activity, and a growing inventory base that supports sustained demand.

Overall, the market continues to demonstrate resilience, with stable pricing trends, increased sales activity, and a growing inventory base that supports sustained demand.

* all graphs/data are for single-family homes in Salt Lake, Utah, and Davis Counties.

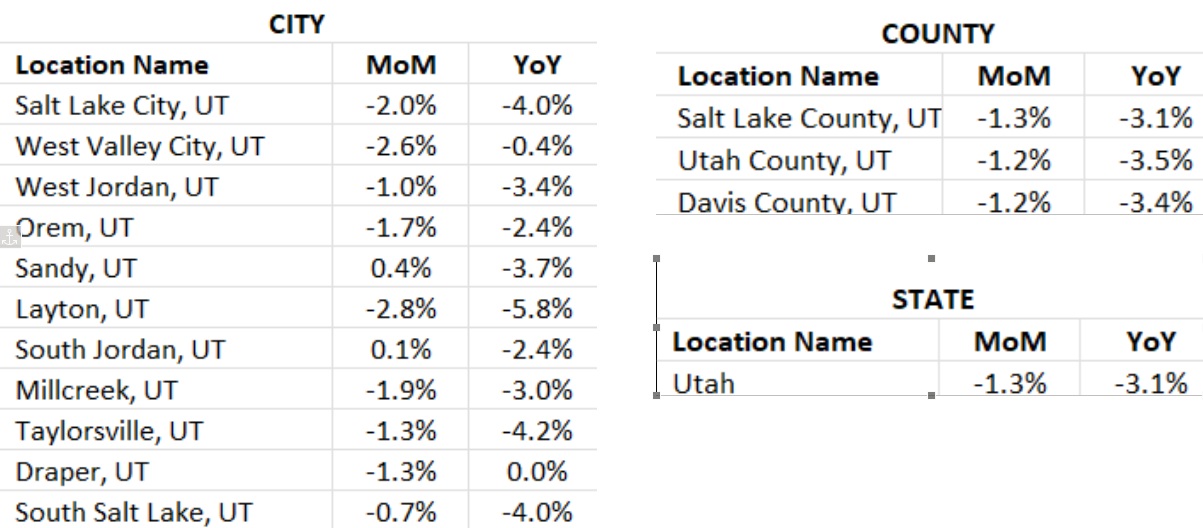

Rent Report

In November, the rental market in Utah continued its downward trend, with both month-over-month (MoM) and year-over-year (YoY) metrics reflecting declines across cities, counties, and the state overall. Layton experienced the steepest declines (-2.8% MoM, -5.8% YoY), highlighting significant challenges in that area. Conversely, Sandy (+0.4% MoM) demonstrated a slight positive movement. At the county level, Utah County and Davis County saw similar declines. Statewide, Utah observed a -1.3% MoM and -3.1% YoY decrease, underscoring broader challenges in the rental market.

*Rental data provided by apartment list.

Industry Updates

Salt Lake City Ranks As A Top Place For Landlords In 2025 - In early 2025, landlords and property investors are focusing on promising markets, with Salt Lake City and Phoenix standing out as top choices. Salt Lake City, highlighted by TurboTenant CEO Seamus Nally, offers landlord-friendly conditions, including minimal rent control, relaxed regulations, and below-average homeowners insurance costs. High demand in the area often results in bidding wars, further benefiting landlords. Other cities identified as attractive for landlords include Columbus, Phoenix, Nashville, Charlotte, and Denver.

NAA's Rent Control Outlook - Rent control remains a hotly debated issue in the U.S., with increasing legislative activity at state and local levels. In 2024, the National Apartment Association (NAA) tracked 218 state-level rent control bills, with 22 enacted, and numerous local initiatives aiming to adopt or strengthen rent control. Despite evidence of negative impacts, such as reduced housing supply and property maintenance challenges, states like California, New York, and Colorado are expanding these policies, while others like Idaho have pushed back with preemptive legislation. The NAA continues to oppose rent control through advocacy and partnerships, achieving key wins like amending Maryland’s rent cap proposal and defeating federal efforts to limit rent increases. As debates intensify, states such as California, Illinois, and Maryland are expected to be focal points in 2025, with NAA prioritizing housing supply solutions and industry protection.

Summarize this content with AI:

Chat GPTGrok

Perplexity

Claude.ai